|

July (2024)

ASTM: Proposes New Standard for Storage Guidelines for rCB Link...

ASTM under subcommittee D36.40 are developing a standard under WK73460 designed to inform users of the impact of long-term storage on rCB performance.

Goodyear: Announces Sale of OTR Tire Business to Yokohama Link...

Goodyear has announced that it has signed a definitive agreement to sell its Off-the-Road (OTR) tire business to Yokohama Rubber Company. Goodyear's OTR tire business provides OTR tires around the world for surface and underground mining, construction and quarry, and port and industrial end markets. Goodyear will retain its business providing OTR tires for U.S. military and defense applications. Pursuant to a Product Supply Agreement to be entered into with Yokohama in connection with the closing of the transaction, Goodyear will manufacture certain OTR tires for Yokohama at some of its manufacturing locations for an initial period of up to five years after the closing of the transaction.

Trelleborg A.B.: Finalises Acquisition of Baron Group Link...

Trelleborg Group has finalized its acquisition of Baron Group. The company is a global leader in the manufacturing of advanced precision silicone components. The company has its head office and two manufacturing facilities in Australia, as well as two additional facilities in China. The business primarily focuses on medical technology solutions and will become part of the Trelleborg Medical Solutions business area, established on April 1, 2024.

RCCL News:

Recovered Carbon Black Approvals and Markets - Practical Guide 2024 Link...

| |

Attention Investors & Recovered Carbon Black Manufacturers

Expert guidance for recovered carbon black (rCB) approvals and markets. This guide has been written by a rubber industry expert with 'hands-on' knowledge of approvals processes as well as tire and rubber formulations and performance. Approvals processes are discussed in detail, including: preparing for an approvals process, what to expect, how to overcome problems and how to use approvals as a key learing process. The recovered carbon black market is analysed transparently, explaining the assumptions and allowing clients to adjust the model if required. This market analysis is critical to your forward planning and is highly recommended. This detailed guidance for approvals and markets is not available anywhere else.

Find out more » |

Yokohama Rubber: In Advanced Talks to Acquire Goodyear's OTR Tire Business Link...

Yokohama Rubber is reportedly in advanced negotiations to acquire Goodyear Tire & Rubber Co.'s OTR tyre business

Trelleborg A.B.: Expanding US Engineered Coated Fabrics Business Link...

Trelleborg Group has decided to invest in a new production facility to expand its business for engineered coated fabrics in Rutherfordton, North Carolina, US. The establishment will primarily aim to strengthen Trelleborg's leading positions in aircraft escape slides, water infrastructure, and advanced materials for healthcare and outdoor products. Trelleborg are adding new technology, production and development capacity in a state-of-the-art facility, strengthening its role as a long-term partner to its customers.

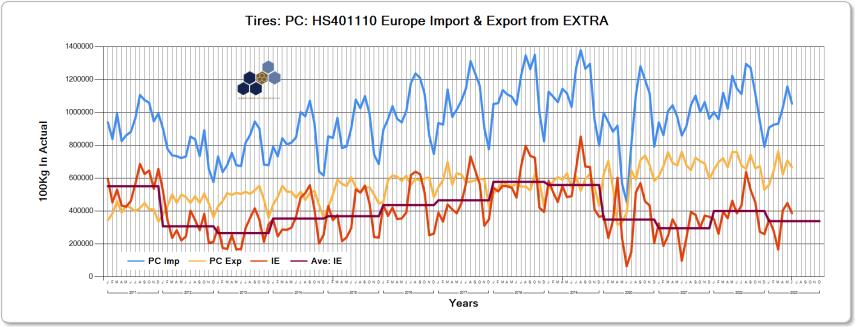

Continental Rubber Group: Expanding PC Tire Capacity at Its Rayong, Thailand Plant Link...

Continental is expanding capacity for PC tires at its 5-year-old factory in Rayong in response to growing demand for premium tires in the region and for export to USMCA. Further details are to follow.

Lyondellbassell: Expanding PP Compounding Capacity in China Link...

Lyondellbassell is starting up a second 20 kMTpa high-performance PP compounding line at its Dalian, China plant (part of its Advanced Polymer Solutions business). The expansion is required to support the rapidly growing automotive market, especially EVs, in China.

Dow Chemical: Announces Bio-Based EPDM at DKT 2024 Link...

Dow announced the launch of NORDEL™ REN Ethylene Propylene Diene Terpolymers (EPDM), a bio-based version of Dow’s EPDM rubber material that goes into automotive, infrastructure and consumer applications. A key component of automotive weatherseals and hoses, Dow aims to support not just the automotive industry in achieving its sustainability goals with the launch of NORDEL™ REN EPDM, but as EPDM also goes into building profiles, roofing membranes, wire and cable, among others, NORDEL™ REN EPDM can help the decarbonization of building and construction and more.

Yokohama Rubber: Building New PC Tire Plant in China Link...

Yokohama Rubber Co has announced that it will build a new passenger car tire plant in China. The new plant will be located in the Qiantang New District of Hangzhou City, Zhejiang Province, and will have an initial annual production capacity of 9 million tires, with further expansion to be considered in the future. Planned capital investment is RMB1,960 million (approx. ¥36.7 billion), and production at the new plant is scheduled to start in the second quarter of 2026. The decision to construct a new plant is a response to a request for relocation of the plant currently operated by Hangzhou Yokohama Tire Co., Ltd., a local tire production subsidiary, as part of an urban renewal project. The new plant will be constructed in another location in Qiantang and be operated by Hangzhou Qiantang Yokohama Tire Co., Ltd., a new company being established as part of the district, city, and provincial governments’ important project promoting foreign investments. To meet expected further increases in tire demand in China, the new plant will increase Yokohama Rubber’s current annual production capacity in the country by 3 million units. Its output will include tires sold as original equipment for new energy vehicles (NEVs), including electric vehicles (EVs). In addition, the new plant aims to increase the sales ratio of high-value added Yokohama Rubber tires in China’s replacement tire market by increasing local production of high-inch tires in the ADVAN global flagship brand and the GEOLANDAR brand of tires for SUVs and pickup trucks.

Nokian Tires: New Romania Factory Produces First Tire - Factory on Schedule to Start Commercial Production in 2025 Link...

Nokian Tyres’ new passenger car tire factory being built in Oradea, Romania produced its first tire on July 1. The milestone was reached as planned, and the building project is progressing in budget and on schedule for commercial tire production to start in early 2025. The groundbreaking of the factory was celebrated in May 2023. The annual capacity of the Nokian Tyres Romania factory will be 6 million tires once the factory is fully operational, with expansion potential in the future, and the combined built-up area totals some 100,000 m2. The investment is estimated to total approximately EUR 650 million. The tires produced in the Romania factory will be primarily sold in the Central European market, and it is strategically located close to the customers of that area.

June (2024)

Wacker Chemie AG: Breaks Ground on New Speciality Silicone Plant in Czech Republic Link...

Wacker Chemie AG has broken ground on the new Karlovy Vary production plant. From the end of 2025, WACKER will produce room-temperature curing high-performance silicones and from 2028 high consistency silicone rubber in Karlovy Vary. These silicones are used in key technologies such as electromobility, health and medical care and in grid expansion. The investment volume is in the low triple-digit million-euro range.

Continental Rubber Group: Grand Opening of 4th Expansion at Hefei Tire Plant, China Link...

Continental has celebrated the grand opening of the fourth expansion phase of its tire plant in Hefei, China. This expansion increases annual production capacity to 18 million PCR and LTR tires by 2027. The expansion includes increases in production capacity of UHP tires for the APAC region.

LD Carbon: Closes $28M Series C Funding Led by Toyota's Growth Fund Link...

LD Carbon, a Seoul, South Korea-based producer of recovered carbon black (rCB), has closed a $28 million Series C funding round led by Toyota's growth fund. LD Carbon will use the investment to scale operations to recycle end-of-life tires and materials from end-of-life vehicles into rCB and tire pyrolysis oil(TPO) through pyrolysis, which can be used to create new automotive parts and tires. The company says the investment will advance its mission of accelerating the circular economy while delivering material cost and carbon savings to global customers. LD Carbon's plant in Gimcheon, South Korea, has an annual capacity of more than 7,000 tons of rCB, which it then supplies to tire and rubber manufacturers. D Carbon also is investing in the construction of a tire pyrolysis plant in Dangjin City, South Korea, with completion slated for later this year. Its annual capacity reportedly will be 50,000 tons of end-of-life tires turned into 22,000 tons of TPO, 18,000 tons of rCB and 10,000 tons of other materials. LD Carbon says it is co-developing key product specifications alongside several global tire makers and industry leaders.

Elkem: Starts Production at Expansion Project in China Link...

Elkem has started production at a major silicone expansion project in China. The expansion provides an additional 200 kMTpa of monomer and 120 kMTpa of downstream silicone products giving the Xinghou Industrial Park site a total of 700 kMTpa of monomer and 3000 kMTpa of downstream products.

Michelin: Troyes Plant Implements COSMOS a New Agricultural Tire Manufacturing Machine Link...

The new COSMOS system, implemented at the Troyes Plant which accounts for 40% of Michelin's global agricultural tire capacity, enables more flexible production of new tire sizes using 20% less solvents.

Orion Engineered Carbons: Installing Multiple Tire Pyrolysis Oil Tanks at Jaslo, Poland Plant Link...

Orion is installing multiple tire pyrolysis oil tanks at its plant in Jaslo, Poland as part of its initiatives for producing circular carbon black. The tanks will serve as reception points for TPO delivered to the plant. The TPO will be pumped from the tanks to furnace black reactors, which transform the oil into circular carbon black.

Bridgestone: Reducing Workforce at Des Moines Agri Tire Plant Link...

Bridgestone has issued a WARN notice for workforce reduction at its Des Moines Agricultural tire plant in Iowa. The reduction, equivalent to one shift, is due to soft agricultural market conditions which have prevailed for over a year.

Zeon Corporation: Reducing Elastomer Capacity at Tokuyama Plant Link...

As part of its portfolio restructuring plan, Zeon is reducing elastomer capacity at its Tokuymam plant by 60%. The reduction sees the closure of its NBR-LX production line as well as Line 1 of its E-SBR capacity both by end of 2026 also with planned closure of its BR line at an unconfirmed date. This together with an announced plan to build a new COP plant, will help improve the profitability of the elastomers business.

Zeon Corporation: Increasing Global Selling Prices for TPEs and Hydrocarbon Resins Link...

Zeon Corporation has announced global selling price increases for TPEs (SIS Quintac®) of 330 USD/MT and Hydrocarbon Resin (Quintone®) of 330 USD/MT effect July 1st 2024 due to increased raw material, energy and logistics costs.

Covestro: Partners with Neste and Borealis to Recycle ELTs into High-Quality Automotive Plastics Link...

Neste, Borealis and Covestro have signed a project agreement to enable the recycling of discarded tires into high-quality plastics for automotive applications. The collaboration aims at driving circularity in plastics value chains and the automotive industry. As part of the collaboration, Neste turns liquefied discarded tires into a high-quality raw material for polymers and chemicals manufacturing and supplies it to Borealis. Borealis will then process the Neste-produced raw material into base chemicals phenol and acetone, which are supplied to Covestro. Covestro can use these materials to make polycarbonates. The share of recycled content is attributed via the mass balancing approach all the way to the final products using ISCC Plus certification.

Phillips Carbon Black Ltd: 2023 Q4 Results Link...

PCBL: New Tamil Nadu plant operated at 60% capacity in Q4 - expected to reach full capacity in Q3 of current FY. Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q4 | 14934.5 | 13738.1 | 8.7 | | | All Segments | EBIT | Q4 | 2494.6 | 1664.5 | 49.9 | | | All Segments | Net Margin | Q4 | 1223.9 | 797.6 | 53.4 | | | Carbon Black | Sales Revenue | Q4 | 14532.7 | 13351.2 | 8.8 | | | Carbon Black | EBIT | Q4 | 2464.5 | 1691.7 | 45.7 | | | Carbon Black | Sales Vol MT | Q4 | 142000.0 | 119238.0 | 19.1 | |

Phillips Carbon Black Ltd: Further Expansion Plans for Tamil Nadu Plant Link...

PCBL are moving forward with an expansion of their new Tamil Nadu plant. This will be done in two phases: 1st 30kMTPa and 2nd 60kMTPa with completion expected next year. Once this expansion is complete PCBL will have a total capacity of 880kMTpa. Evaluation is also underway for a new greenfield plant which will take PCBL's capacity to over 1 million MTpa allowing PCBL to capture more global market share.

May (2024)

China Synthetic Rubber Corporation: Partners with SHEICO to Establish Largest Eco-Friendly Carbon Black Plant in North America Link...

The board of directors of CSRC group today approved a plan to partner with Eco Infinic Co., Ltd., a Thailand subsidiary of SHEICO group. The partnership aims to invest in the recovered carbon black (rCB) business at the original site of Continental Carbon Company (CCC) Phenix plant, jointly developing the North American market for recovered carbon black. This new plant is scheduled to commence production in 2026, and expected to become one of the largest recovered carbon black plants in North America. The joint venture plant 65% owned by EcoInfinic with CSRC and CCC holding 35% is expected to commence production in 2026 with an annual capacity of 30k tons rCB, 35k tons of TPO and 2.3k tons steal wire.

Shin-Etsu: Building New Silicone Products Plant, Zhejiang, China Link...

Shin-Etsu Chemical Co., Ltd. has decided to establish a new company, Shin-Etsu Silicone (Pinghu) Co., Ltd., in Zhejiang Province, China, and construct a new silicone products plant to expand its silicone business. The new plant will be built in the Dushan Port Economic Development Zone in Pinghu City, Zhejiang Province, about 85 km from Shanghai. The site has an area of 40k m2 (including 20k m2 of land planned for future expansion), which is twice the area of the current plant. In addition to existing general-purpose silicone emulsion products, the new plant will produce functional silicone emulsions, environmentally friendly silicone products, and other high-functional products, and is scheduled for completion in February 2026. The total investment is expected to reach approximately 2.1 billion yen, including the cost of the land for the project. The production functions that the current plant in Zhejiang Shin-Etsu has fulfilled will also be transferred to the new plant.

Circtec: Complete Funding for Europe's Largest ELT Pyrolysis Recycling Facility Link...

Novo Holdings and A.P. Moller have enabled a €150 million fundraise for Circtec via a €75 million equity investment including €22.5 million of grants awarded by the Government of the Netherlands. This funding enables Circtec to construct Europe's largest end-of-life (ELT) tire pyrolysis plant in Delfzijl, Netherlands. The construction was announced on 17th May at a ceremony attended by offtake parties BP and Birla Carbon as well as agencies of the Government.

Metso: Expanding Chile Operation Link...

Metso is expanding its factory in Concón to further increase its rubber and Poly-Met production capability. Metso has installed a mega-class compression press that will expand the range, sizes, and types of products manufactured. With its robust technology and large size, the press is specifically designed to produce large Megaliner™ mill liners that can weigh up to 8 tons. After the introduction of the new press, the production capacity for large mill liners will increase by 30%.

Yokohama Rubber: Expanding Motorsports Tire Production at Its Mishima Plant Link...

Yokohama Rubber has announced its plan to expand motorsports tire production capacity at its Mishima Plant in Mishima City, Shizuoka Prefecture by investing about ¥3.8 billion in a new line that will produce 18-inch and larger motorsports tires, expanding the plant’s capacity for motorsports tires by 35%. Construction will begin in the third quarter of 2024, and production on the new line is planned to begin near the end of 2026 and be brought up to full capacity in the third quarter of 2027.

Orion Engineered Carbons: Invests to Upgrade Alpha Carbone Facility Link...

Orion S.A. has announced it is investing in Alpha Carbone, a French tire recycling company. The partnership will enable Alpha Carbone to scale up and produce commercial volumes of tire pyrolysis oil and recovered carbon black. The cooperation also includes a long-term supply agreement with Orion as the exclusive customer for the tire pyrolysis oil produced by Alpha Carbone. The oil will be used by Orion to manufacture circular carbon black for tire and rubber goods customers. Alpha Carbone’s plant is expected to start up in late 2025. Besides the pyrolysis oil supplied to Orion, Alpha Carbone will sell the recovered carbon black to its own customers primarily under long-term contracts.

Orion Engineered Carbons USD: 2024 Q1 Results Link...

Orion Engineered Carbons USD: Good volume recovery for specialist carbon blacks across all regions and markets. Small volume (2.5%) recovery in rubber carbon blacks in EMEA and APAC. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q1 | 502.9 | 500.7 | .4 | | | Carbon Black | adjEBITDA | Q1 | 85.3 | 101.0 | -15.5 | | | Carbon Black | EBITDA | Q1 | 81.7 | 99.2 | -17.6 | | | Carbon Black | EBIT | Q1 | 52.8 | 73.5 | -28.2 | | | Rubber Black | Sales Revenue | Q1 | 332.0 | 338.7 | -2.0 | 1 | | Rubber Black | adjEBITDA | Q1 | 57.4 | 63.8 | -10.0 | 2 | | Rubber Black | Sales Vol MT | Q1 | 185100.0 | 180500.0 | 2.5 | 3 | | Specialist Black | Sales Revenue | Q1 | 170.9 | 162.0 | 5.5 | | | Specialist Black | adjEBITDA | Q1 | 27.9 | 37.3 | -25.2 | 4 | | Specialist Black | Sales Vol MT | Q1 | 63300.0 | 53000.0 | 19.4 | |

Cabot Corporation: 2024 Q2 Results Link...

Cabot Corporation: Reinforcement volumes up 6% YoY with growth in Europe and Asia. Speciality carbons volumes up 6%. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q2 | 906.0 | 913.0 | -.8 | 1 | | Carbon Black | EBIT | Q2 | 171.9 | 142.7 | 20.5 | | | Rubber Black | Sales Revenue | Q2 | 676.0 | 672.0 | .6 | 2 | | Rubber Black | EBIT | Q2 | 149.0 | 122.0 | 22.1 | | | Rubber Black | Sales Vol YoY % | Q2 | 106.0 | 93.0 | 14.0 | 3 | | Specialist Black | Sales Revenue | Q2 | 230.0 | 241.0 | -4.6 | 4 | | Specialist Black | EBIT | Q2 | 22.9 | 20.7 | 10.7 | | | Specialist Black | Sales Vol YoY % | Q2 | 106.0 | 95.0 | 11.6 | 5 |

China Synthetic Rubber Corporation: 2024 Q1 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q1 | 4416.5 | 4410.8 | .1 | | | Carbon Black | EBIT | Q1 | -10.7 | 103.8 | -110.3 | |

Tokai Group: 2024 Q1 Results Link...

Tokai Group: Volumes slightly down due to continued inventory adjustments for RP tires. Net sales increased with a small drop in operating income reflecting +FX flows, despite increased depreciation due to environmental investment. Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q1 | 39602.0 | 37406.0 | 5.9 | | | Carbon Black | EBIT | Q1 | 5696.0 | 5757.0 | -1.1 | |

Jiangxi Black Cat Carbon Black: 2024 Q1 Results Link...

Jiangxi Black Cat Carbon Black is China's biggest producer of furnace carbon black with capacity at just over 1 million metric tonnes. Rubber Chemical Consultants tracks Jiangxi Black Cat for total financial performance as well as performance in furnace black and precipitated silica production. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q1 | 2384.9 | 2206.2 | 8.1 | | | All Segments | EBIT | Q1 | 8.2 | -104.1 | 107.9 | |

Longxing Chemical Stock: 2024 Q1 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q1 | 1000.6 | 1119.5 | -10.6 | | | All Segments | EBIT | Q1 | 34.5 | 17.9 | 92.7 | |

Jinneng Science & Technology: 2024 Q1 Results Link...

Jinneng Science & Technology have an integrated chemical operation including coking, chemical production, coal tar deep processing, carbon black and silica production. RCCL follows Jinneng's full operational results (all segments) and studies individual carbon black and silica segment performance. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q1 | 3386.5 | 3441.8 | -1.6 | | | All Segments | EBIT | Q1 | -27.5 | -162.4 | 83.1 | |

Yongdong Chemical Industry: 2024 Q1 Results Link...

Yongdong Chemical Industry is active in coal tar processing and carbon black production. Carbon black production includes reinforcing, conductive and pigment grades of carbon black. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q1 | 960.1 | 1138.8 | -15.7 | | | All Segments | EBIT | Q1 | 37.0 | -5.1 | 823.1 | |

Trelleborg A.B.: Establishes Aero Sealing Production in Morocco Link...

Trelleborg is investing in a new aerospace sealing solutions production unit in Morocco in support of local customers and the aero industry's strong global growth, with Casablanca developing into a hub for aerospace companies. The production facility will be established in the Midparc Industrial Freezone, in Casablanca. The state-of-the-art facility will get a substantial part of its energy supply from solar panels on its roof. The facility will initially have a surface area of more than 5,000 square meters and will be adapted to meet the stringent requirements of suppliers in the aviation industry.

CooperStandard: Further Reductions in Workforce and Industrial Footprint Review Link...

CooperStandard are looking to streamline operations following their restructuring along product-lines. There will be an immediate reduction in salaried workforce with a $20-$25 million cost saving for 2024, with a full annualised cost saving of $40-$45 million in 2025. CooperStandard see significant upsides in their fluid handling business with sophisticated system requirements for EVs and also substantial product content in hybrid vehicles.

RCCL Analysis:

Rubber Goods Market Analysis for Rubber Chemical Demand Link...

Analysing the non-tire Rubber Goods Industry (also known as MRG) for rubber chemical demand can be challenging due to the diversity of sectors/applications and third party compound supply. The MRG industry serves a wide number of sectors with a diverse range of applications, this makes it difficult to allocate compound volumes/chemicals to the appropriate sector/application. The European and USMCA MRG sectors also utilise custom compounders for significant quantities of mixed compound (RCCL estimates approximately 50% of European compound volume was provided by custom compounders in 2023). As these third party compound suppliers serve many market sectors (including the Tire industry) it adds a layer of obscurity relating to their compound production and final end market. Over the past 15 years Rubber Chemical Consultants (RCC) has completed many projects looking at the MRG sector in detail, verifying demand via bottom-up and top-down analysis as well as comparison with client corporation findings. Many completed projects have combined client and RCC knowledge to arrive at firm conclusions. These learnings are incorporated into RCC’s Global Tire and Rubber Chemical Database so that successive projects can build on the knowledge gained from previous projects. The example charts show European rubber compound demand and furnace carbon black demand by sector for 2011 to 2030. It is convenient to split the MRG market into sectors, this shows that the Automotive sector is the most significant, followed by the Industrial and Construction sectors. This information gives a general overview, however, it can combine conflicting trends in underlying compound types. For example, the Automotive Sector is currently transitioning in technologies driving changes in MRG product mix and requirements, it is therefore necessary to dig deeper than the sector level to gain a full understanding of past, present and future requirements. Expanding on this: Each of these sectors can be subdivided into generic applications (e.g. Anti-Vibration, Belts, Conveying, and Hoses etc.) which help to differentiate underlying rubber formulations and chemical use. The can be broken down further into specific application types to provide additional granularity for bespoke projects (e.g. Automotive - Hoses can be segmented into specific underlying types). In summary, the MRG Industry provides some specific challenges when analysing rubber chemical demand. RCC has acquired significant expertise in this area through multiple projects and accumulated knowledge. The best client outcomes generally result from collaborative iterative studies, however, RCC can accommodate any client request or working arrangement. Please contact us with you requirements.  Contact Us For Further Information » Contact Us For Further Information »

Freudenberg & Co: Sealing Technologies Acquires Trygonal Group Link...

Freudenberg Sealing Technologies Business Group has acquired the Trygonal Group, strengthening its global business unit Freudenberg Xpress, an expert in small and medium batch sizes, rapid prototyping and customer-specific sealing solutions. The Trygonal Group has eight locations in Germany, Spain, Austria and Switzerland producing high-quality, customized sealing solutions in the areas of thermoplastics, elastomers and rubber-metal compounds using a wide range of manufacturing processes.

Circtec: Signs Eight Year Offtake and Funding Agreement with BP Link...

bp has signed an eight-year offtake agreement with Circtec committing bp to purchasing 60 kMTpa of Circtec's HUPA™, a renewable drop-in marine fuel and up to 15 kMTpa of circular naphtha petrochemical feedstock, on a take-or-pay basis, from Circtec's new commercial-scale plant, for eight years after the plant has been commissioned. The €285 million new plant, currently awaiting construction in Delfzijl, The Netherlands, will be constructed to have the capacity to process 200,000 tonnes per year of waste

tyres into HUPATM renewable drop in marine fuel, circular naphtha petrochemical feedstock and circular chemical recovered carbon black (rCB). Construction of the new plant is planned to start this year with the first phase of the plant intended to become operational in 2025. bp has also committed to providing €12.5 million of investment through debt capital, to support the €100 million development of the first phase of the Delfzijl plant.

April (2024)

Yongdong Chemical Industry: 2023 Q4 Results Link...

Yongdong Chemical Industry is active in coal tar processing and carbon black production. Carbon black production includes reinforcing, conductive and pigment grades of carbon black. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q4 | 1211.9 | 1264.4 | -4.2 | | | All Segments | EBIT | Q4 | 41.9 | -23.4 | 279.4 | | | All Segments | Net Margin | Q4 | 37.7 | -14.3 | 364.6 | |

Jinneng Science & Technology: 2023 Q4 Results Link...

Jinneng Science & Technology have an integrated chemical operation including coking, chemical production, coal tar deep processing, carbon black and silica production. RCCL follows Jinneng's full operational results (all segments) and studies individual carbon black and silica segment performance. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q4 | 3670.1 | 2699.4 | 36.0 | | | All Segments | EBIT | Q4 | 84.6 | -88.8 | 195.2 | | | All Segments | Net Margin | Q4 | 70.7 | -10.8 | 754.0 | |

RCCL Analysis:

Rubber Industry Chemical Demand: Furnace Carbon Black Market Demand by Region and Tire Group Link...

Analysing rubber industry chemical demand requires a detailed analysis of the tire and rubber goods manufacturing landscape. Key considerations are: manufacturing capacities, products and technology changes. These need to be combined with market drivers and trends, which can be used to fine-tune capacity utilisations by product. The example shows furnace carbon black demand by region and tire type. There are significant demand differences based on region and underlying tire type. These differences are driven by domestic market demand, trade opportunities, material availability and underlying product technologies. These differences should be considered in relation to new material development and market introduction. New material introductions into lower tech products and markets is typically faster, but with a lower realisable price. The reverse is true for higher tech products. Volume opportunities also vary widely depending upon the chosen region and target product group. Contact Us For Further Information »

Arlanxeo: Celebrates Groundbreaking of New HNBR Plant in China Link...

ARLANXEO held a groundbreaking ceremony for its new Therban® hydrogenated nitrile butadiene rubber (HNBR) plant in Changzhou, China on 23rd April 2024. The plant has a nameplate capacity of 5k MTpa, the first phase of construction will allow for the production of 2.5k MT of high-quality rubber per year. The plant is expected to begin operations in the third quarter of 2025.

Yokohama Rubber: Breaks Ground on New PCR in Mexico Link...

Yokohama Rubber held a groundbreaking ceremony on April 15 2024 ahead of the start of construction of its new passenger car tire plant located at Alianz Industrial Park, Saltillo, Coahila, Mexico. The new plant will increase Yokohama Rubber’s tire production capacity in North America, enabling the Company to meet an expected increase in future demand in the region with tires produced locally in the region. The Mexico plant will have an annual production capacity of 5 million tires. Construction will begin during the second quarter of 2024, with production scheduled to start in the first quarter of 2027. The Company will also consider expanding the plant’s capacity in the future. The consumer tire strategy in Yokohama Rubber’s new three-year (2024–2026) medium-term management plan, Yokohama Transformation 2026 (YX2026), aims to maximize the sales ratios of high-value-added tires by expanding sales of YOKOHAMA’s global flagship ADVAN brand, the GEOLANDAR brand of tires for SUVs and pickup trucks, winter tires, and 18-inch and larger tires. It also will continue its “Product and Regional Strategies” focused on strengthening the development, supply, and sales of tires that respond to specific trends in each regional market.

Scandinavian Enviro Systems AB: Pyrolysis Oil Successfully Processed into Chemicals Raw Materials by Neste Link...

Scandinavian Enviro Systems’ recovered pyrolysis oil has been successfully processed into high-quality raw materials for chemicals and plastics by the Finnish company Neste. The successful processing run was done at Neste’s refinery in Porvoo, Finland. The pyrolysis oil had been delivered from Enviro’s plant in Åsensbruk where Enviro uses its proprietary and patented pyrolysis technology to recover valuable raw materials, such as carbon black and oil, from end-of-life tires. Neste has previously already successfully produced raw materials for plastics and chemicals from liquefied plastic waste.

Jiangxi Black Cat Carbon Black: 2023 Q4 Results Link...

Jiangxi Black Cat Carbon Black is China's biggest producer of furnace carbon black with capacity at just over 1 million metric tonnes. Rubber Chemical Consultants tracks Jiangxi Black Cat for total financial performance as well as performance in furnace black and precipitated silica production. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q4 | 2657.8 | 2588.9 | 2.7 | | | All Segments | EBIT | Q4 | 32.5 | -25.2 | 229.0 | | | All Segments | Net Margin | Q4 | -215.6 | -28.4 | -658.2 | |

Synthomer Plc: Divests Compounds Business Link...

Synthomer has announced an agreement to divest its latex compounding operations to Belgian company Matco NV, a leader in compounds, water-based adhesives, and solutions for various industrial applications, for consideration of c.€27.5m. The Compounds business, which is part of Synthomer's Health & Protection and Performance Materials division, was designated as non-core to the Group as part of the strategy update announced in October 2022. It produces certain latex-based compounds and curing additives used in the manufacture of products for a range of end markets including flooring and artificial grass. The business comprises two manufacturing sites in the Netherlands and one in Egypt.

Companhia Nacional de Borracha SA: Acquired by Nova Motorsport Link...

Nova Motorsport has acquired Portuguese based tire maker Companhia Nacional de Borracha SA (Camac) as part of its plans to become a competition tire manufacurer. The facility currently has production capacity in the region of 500k tires pa.

Orion Engineered Carbons: Breaks Ground on Battery Materials Plant in Texas Link...

Orion has broken ground on a plant in Texas that will be the only facility in the U.S. producing acetylene-based conductive additives for lithium-ion batteries and other applications vital for the global shift to electrification. The site is based in the city of La Porte, southeast of Houston. The battery additives produced by Orion’s plant will be super clean, with only one-tenth of the carbon footprint of other commonly used materials. The additives produced at the La Porte plant will be made from acetylene, a colorless gas that Orion’s production process turns into powder with exceptional purity demanded by leading battery manufacturers. The acetylene will be supplied by a neighboring site owned by Equistar Chemicals LP, a subsidiary of LyondellBasell. Key equipment procurement and off-site fabrication are already at an advanced stage. Field construction activities are ramping up, with the facility start-up expected in the second quarter of 2025.

Bridgestone: Investing in High-Value PC Tire Production in China Link...

Bridgestone is expected to invest a total of approximately 562 million yuan in its PCR plants in China over the next three years. The investment will focus on increasing the proportion of high-performance passenger car tire production, aiming to better meet the diverse needs of the Chinese consumer market and provide higher-end and diversified products and services. The main investment of US$26 million is for Bridgestone (Wuxi) Tire Co., Ltd. in 2024 to expand the production capacity of high-end passenger car tires. After the factory is upgraded, it will increase the production of tires using ENLITEN® technology, and is committed to applying the group's ENLITEN® technology, which uses unique recyclable materials and new mixing processes, to more tire products to improve tire wear performance and extend tire service life. and vehicle mileage to achieve the purpose of saving resources, reducing carbon emissions, and contributing to the realization of Bridgestone's sustainable development goals. At the same time, in order to meet the needs of Chinese consumers for a quiet and comfortable driving environment, the factory will also add a tire production line equipped with B-SILENT silent cotton technology, and the annual tire output is expected to reach 2 million. In addition to Bridgestone (Wuxi) Tire Co., Ltd., Bridgestone Group has also increased its investment in Bridgestone (Tianjin) Tire Co., Ltd. At the end of 2023, Bridgestone (Tianjin) Tire Co., Ltd. has planned to invest 54.73 million yuan to transform the equipment in the existing factory area, and plans to complete the construction and put into production in August 2025.

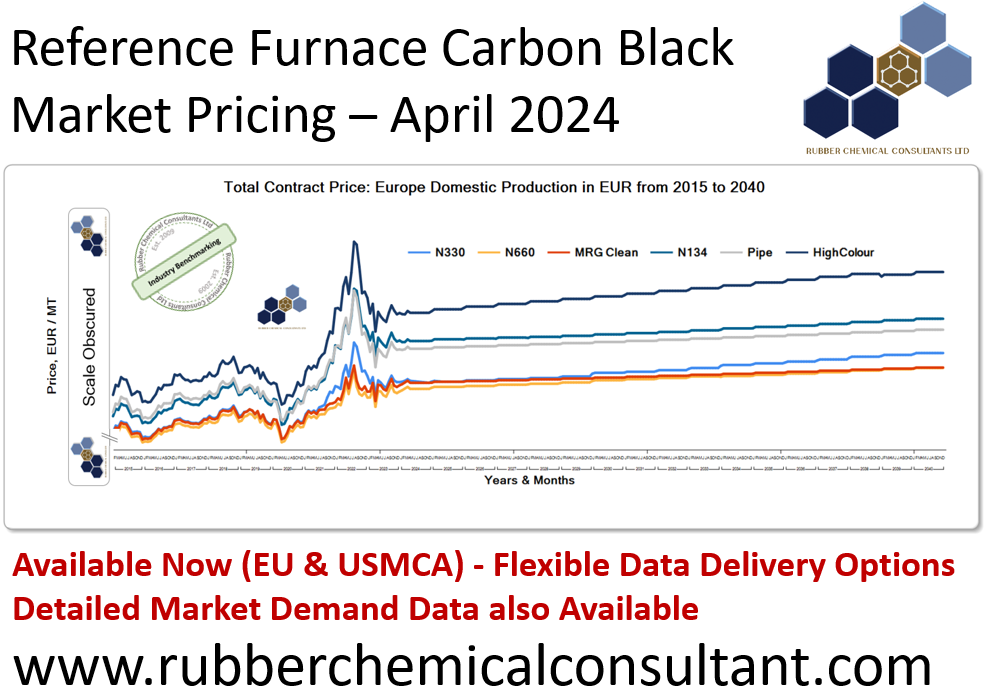

RCCL Analysis: European Furnace Carbon Black Reference Market Pricing - April 2024 Link...

Furnace carbon black reference market pricing April 2024 for European and USMCA domestically produced products. Detailed market pricing derived from our fully benchmarked market analysis system bringing together all the key market demand and price drivers, including, but not limited to: rubber, plastic and speciality sector production changes; variations in international trade, exchange rates, product technologies, product mixes, feedstock pricing and surcharges, EPA impacts and emissions surcharge. Past, present and future market demand by region, sector (Tire, MRG, Plastics, Others) also available. Deep-dive market analysis available for Europe and USMCA. Contact us if you have requirements – flexible data delivery options available.  Contact Us For Further Information » Contact Us For Further Information »

March (2024)

Cabot Corporation: Wins Tire Technology International 2024 Award for Its E2C® DX9660 Engineered Elastomer Composite Link...

Cabot Corporation has won the Tire Technology International 2024 Awards for Innovation and Excellence in the “Chemicals and Compounding Innovation of the Year” category for its E2C DX9660 engineered elastomer composite. The award recognises Cabot's E2C DX9660 as a solution that delivers performance and sustainability benefits for tire customers across the globe. E2C DX9660 elastomer composite is produced in a proprietary and patented mixing process that enables superior carbon black dispersion and improved rubber properties for on-road commercial tire applications. Utilizing Cabot’s Light Touch™ mixing guidelines, its DX9660 grade delivers an approximately 30% increase in abrasion resistance without sacrificing rolling resistance over conventional compounds. The on-road performance of this product has been validated by customers globally. Furthermore, by delivering high levels of tread wear resistance, the DX9660 solution results in a reduction of end-of-life tires, thereby enabling a more sustainable future.

Levidian: Unveils Prototype Graphene Enhanced Truck Tire Tread Link...

Launched at the 2024 Tire Technology Expo in Hannover, the graphene-enhanced natural rubber and butadiene rubber tyre tread compound, has been shown to deliver significant improvements in the mechanical and dynamic properties of the tire leading to an improvement in fuel efficiency of 3 to 4%. Levidian’s graphene is produced as part of a unique decarbonisation solution called LOOP that allows tyre producers to drive down the emissions of their manufacturing processes and products through the production of clean hydrogen and high-quality graphene, which can be used as a reinforcing, tread grade carbon filler. Levidian’s solution offers tyre manufacturers the opportunity to not only drive down the emissions associated with production but secure their supply chains by producing their own graphene on site for direct application into their tyres.

Sentaida Group: Advancing Construction of Tangier, Morocco, Phase II Tire Plant Link...

Qingdao Sentury Tire has advanced phase II of its Tangier, Morocco tire plant. This will add 6 million PCR and LTR tires to the current 6 million capacity already under construction.

Cabot Corporation: Launches PROPEL® E8 Engineered Reinforcing Carbon Black for Tire Tread Applications Link...

Cabot has launched its new PROPEL® E8 engineered reinforcing carbon black designed to provide superior tread durability at low rolling resistance for high-performance tire tread applications. The product addresses the unique challenges posed by the heavier weight and higher torque of electric vehicles compared to traditional internal combustion engine vehicles. The PROPEL E8 grade complements Cabot’s existing solutions within the PROPEL E series, which are also suitable for use in high-performance tires. The treads of EV tires require a performance balance difficult to meet with traditional, high surface area ASTM carbon blacks. The PROPEL E8 solution enables better rolling resistance when compared to ASTM N200 and N100 carbon black grades. It also provides high stiffness and modulus with abrasion resistance equal to ASTM N100 series carbon black. The PROPEL E8 grade complements the other solutions in its PROPEL E portfolio including grades PROPEL E3, PROPEL E6 and PROPEL E7, which can also deliver performance and sustainability benefits for various high-performance tire formulations. Cabot’s PROPEL E series is comprised of high surface area, medium structure reinforcing carbon blacks specifically engineered to increase the overall sustainability of the tire value chain, enabling tread formulators to deliver tires with low rolling resistance for maximum range while enhancing tread durability to extend tire life span, resulting in fewer EOLTs. In addition, PROPEL E3 carbon black considerably reduces hysteresis enabling low rolling resistance, which is a critical design consideration for EV tires to maximize range.

Yokohama Rubber: Building New PC Tire Plant in Mexico Link...

Yokohama Rubber has announced that it will build a passenger car tire plant in Mexico to strengthen its capacity to supply tires to the North American market. The new plant will have an annual production capacity of 5 million tires. Construction of the new plant, located in Coahuila state, will start in Q2 2024 with production is scheduled to start in Q1 2027. The new plant will be built on a site which will be able to accommodate future expansion. Yokohama Rubber recognizes that local production for local demand will be indispensable to rapidly meeting the expected increase in demand for tires in the North American market. Its consumer tire strategy for 2024-2026 aims to maximise the sales ratio of high-value-added tires by expanding sales of Advan and Geolandar tires for SUVs and pickup trucks, winter tires and tires with diameters > 18 inches.

RCCL Analysis: Advanced Tire Materials Market Analysis Link...

Detailed tire rubber chemical market analysis requires the appropriate market segmentation by tire type and tire subtype. Rubber Chemical Consultants can analyse this data for a wide range of rubber chemicals.

Please Contact Us For Further Information »

Goldsmith & Eggleton LLC: Carbon Black Masterbatch Plant Enhancements Link...

Goldsmith & Eggleton has announced the completion of the improvement plan for its carbon black masterbatch plant which has minimised the handling of carbon black and rubber in the mixer, improved ergonomics, and increased batch-to-batch consistency. These improvements included the installation of a new internal mixer, automation of the material feed line, improved air filtration, and PLC-controlled weigh-up systems. The turnaround with the new mixer is anticipated to achieve a measurable increase in throughput, allowing G&E to continue offering growth opportunities within its current customer base as well as expanded opportunities for new customers.

Sailun Co: Planning to Build Tire Plant in Indonesia Link...

Sailun has selected Denmark City, Central Java for its next overseas tire plant expansion which will have a capacity of 3.6 million PCRs and 37 kMTpa of OTRs. Completion is set for end of 2025.

Bridgestone: Updating Technological Capabilities at Burgos, Spain Tire Plant Link...

Bridgestone EMEA has announced an historic investment of up to 207 million euros in its Burgos passenger tyre manufacturing site in Spain. The investment aims to raise tyre manufacturing to the highest level of excellence and sustainability. The investment targets production of high-value High Rim Diameter (HRD) tyres (18” and above), with a productivity boost of around 20% compared to the current levels. This increase in manufacturing capacity will help Bridgestone Europe meet customers' demand for premium and high-tech tyres. The Burgos manufacturing facility, one of the largest production sites for Bridgestone passenger car tyres globally, will see a 75% increase in its HRD tyre production capacity to more than 7 million premium tyres. In addition, this transformation will see the Burgos plant become one of Bridgestone’s biggest producers of van tyres in Europe. The manufacturing mix will evolve strategically from the traditional small, low rim diameter tyres (LRD), towards the high-value larger ones.

Goodyear: Planning to Shut Down Shah Alam Tire Plant in Malaysia Link...

Goodyear is planning to shut down its plant in Malaysia on June 30 2024 as part of its Goodyear Forward corporate restructuring program aiming to deliver $1 billion in cost reductions by 2025.

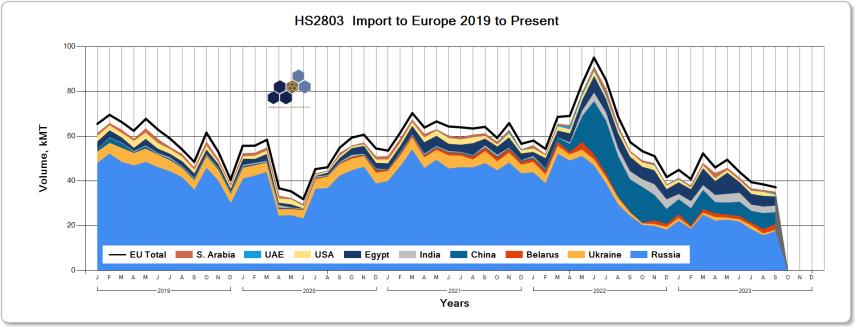

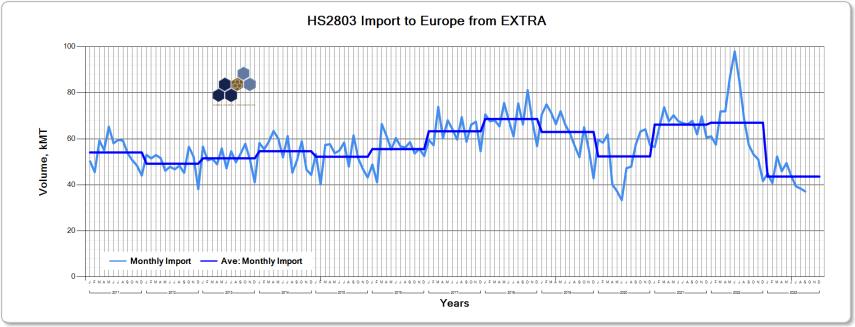

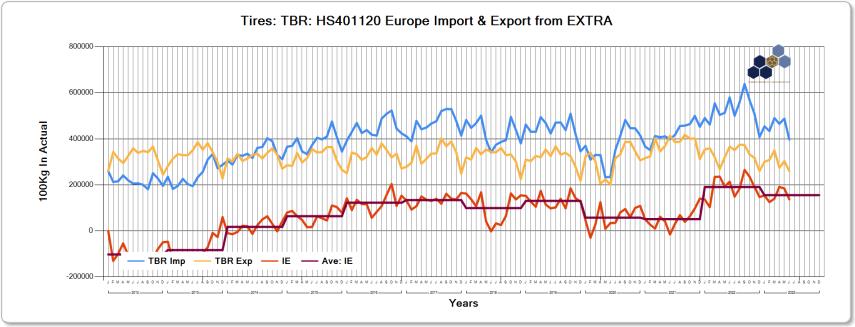

RCCL Analysis: European Carbon Black Imports by Month and Country 2011 to 2023 Link...

Rubber Chemical Consultants analyses carbon black international trade flows looking at past, present and future trends and possibilities. Future movements will be impacted by the requirement to remove the residual Russian import volumes – key factors in this are European carbon black market movements, domestic and EMEA production capacity changes. Additional factors should also be considered - If you want to discuss in more detail please contact us.

Please Contact Us For Further Information »

China Synthetic Rubber Corporation: 2023 FY & Q4 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023 | 17415.6 | 21724.6 | -19.8 | | | Carbon Black | EBIT | 2023 | -124.0 | 339.3 | -136.5 | | | Carbon Black | Sales Revenue | Q4 | 4427.9 | 5215.1 | -15.1 | | | Carbon Black | EBIT | Q4 | 168.3 | -71.8 | 334.3 | |

Dayco: Begins Full Scale Belt Production in Mexico Link...

Dayco completed construction and commissioning of their new belt plant in San Luis Potosi, Mexico ahead of schedule and are now producing commercial belts with production started in January 2024. The facility covers 73,000 square feet and is equipped with state-of-the-art machinery that can produce up to 4.2 million Poly-V belts annually, and which also allows us to expand our production capability to include EPS or timing belts, for example.

Arlanxeo: Planning New HNBR Plant in China Link...

ARLANXEO has announced the planned construction of a hydrogenated nitrile butadiene rubber (HNBR) plant in Changzhou, China. Final installed capacity will be 5 kMTpa with the first phase of 2.5 kMTpa being operational in Q3 2025. ARLANXEO produces and markets HNBR grades under the Therban® brand. Therban® is renowned for its resilience to extreme temperatures, chemicals, and abrasion, and is widely used in demanding applications in automotive systems, oil exploration, mechanical engineering, aerospace, and batteries for new mobility solutions.

Goodyear: Selling Certain Avon Motorsport Assets to UK Company Link...

Goodyear is selling certain Avon motorsport tire assets toTurbalvoroco Unipessoal Lda., which does business as Nova Motorsport. Nova Motorsport is part of SPC Rubber Group and will be located in Holt, Bradford-on-Avon where production is set to start this month, with product availability in 2H 2024.

Titan International Inc: Acquires Carlstar Group Link...

Titan International has announced the acquisition of Carlstar Group LLC for approximately $296 million. Carlstar is a global manufacturer and distributor of specialty tires and wheels for a variety of end-market verticals including outdoor power equipment, power sports, trailers, and small to midsize agricultural and construction equipment. Carlstar operates three manufacturing facilities in the US and one in China. Carlstar also internally manages twelve distribution facilities around the world. Carlstar's global 2023 revenues were approximately $615 million.

February (2024)

Bridgestone: Withdrawing from Commercial TBR Tire Business in China Link...

Bridgestone is strengthening its premium PC Tire focus in China, a plan which has been ongoing since 2021. This effort is being intensified with the ceasation of TBR tire production and sales within the first half of 2024. Bridgestone (Shenyang) Tire Co ceased production on January 26 2024 and Bridgestone (China) Investment Co is plannig to cease operations in the first half of 2024.

SI Group: Strategic Partnership with Liaoning Dingjide Petrochemical Co., Ltd Link...

SI Group has announced a long-term supply partnership with Liaoning Dingjide Petrochemical Co., Ltd. a Chinese-based manufacturer of additives and other specialty chemicals. Through the partnership, Dingjide will manufacture certain SI Group products in China as a co-producer. As a result of the supply agreement, SI Group will cease manufacturing operations at its Jinshan, China manufacturing facility and list the property and associated legal entity for sale.

Thai Carbon: 2023 Q3 Results Link...

Thai Carbon report in one segment: Carbon Black. Currency values reported in: Millions of THB | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q3 | 3295.0 | 2918.7 | 12.9 | | | Carbon Black | Direct Total | Q3 | 2572.4 | 2690.4 | -4.4 | | | Carbon Black | EBIT | Q3 | 191.4 | -831.0 | 123.0 | |

Stomil Sanok: Acquires Teknikum Group Link...

Sanok Rubber Company has agreed to acquire the Teknikum Group which operates four production plants in Finland and one production plant in Hungary. Teknikum's product portfolio includes specialized industrial hoses, including those for cleaning systems used in the mining industry, rubber compounds, molded products for technical applications, made of rubber, silicone and plastics and solutions to protect industrial equipment against wear and corrosion.

Kumho Petrochemical Company: Signs MOU for Establishment of Sustainable Bio Raw Material Supply Chain Link...

Kumho Petrochemical has signed an MOU with SK geo centric and Tongsuh Petrochemical for the establishment of a sustainable bio raw material supply chain. Kumho Petrochemical, SK geo centric, and Tongsuh Petrochemical agreed to cooperate in converting monomers AN(acrylonitrile) and BD(butadiene) from the existing raw material supply chain into bio-monomers. Bio monomers are produced from bio naphtha using environmental-friendly raw materials such as canola oil and waste cooking oil. Under this structure, Tongsuh Petrochemical will supply bio AN using SK geo centric's bio propylene as raw material, and SK geo centric will supply bio BD to Kumho Petrochemical respectively. Through this MOU, Kumho Petrochemical aims to secure a bio-monomer supply chain and plans to expand its environmental-friendly product portfolio by obtaining ISCC PLUS certification for synthetic rubbers(SBR, NBR, HSR, SBL, NBL), as well as synthetic resins(PS, ABS, SAN) within the first quarter of this year. Earlier in last year, Kumho Petrochemical already obtained ISCC PLUS certification on four synthetic rubber items (SSBR, HBR, LBR, NdBR, tire use) manufactured from the Yeosu rubber plant and is expecting to expand to wider range of products this year.

Phillips Carbon Black Ltd: 2023 Q3 Results Link...

Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q3 | 16149.6 | 13314.3 | 21.3 | | | Carbon Black | EBIT | Q3 | 2524.0 | 1671.9 | 51.0 | | | Carbon Black | Sales Vol MT | Q3 | 136108.0 | 92000.0 | 47.9 | |

Tokai Group: 2023 Q4 Results Link...

Tokai Group: Volumes decreased slightly due to prolonged periods of production adjustments for TBR tires and weak demand for non-tire products. Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q4 | 37292.0 | 35134.0 | 6.1 | 1 | | Carbon Black | EBIT | Q4 | 5378.0 | 3296.0 | 63.2 | |

Cabot Corporation: 2024 Q1 Results Link...

Cabot Corporation: Reinforcing: volumes up in Europe and Asia (+2% global), modest sequential volume improvements expected. EBIT improvements through favourable pricing and product mix from 2023 customer agreements. Performance: Volumes up 10% with sequential volume increase expected driven by seasonality. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q1 | 851.0 | 854.0 | -.4 | 1 | | Carbon Black | EBIT | Q1 | 154.1 | 115.4 | 33.5 | | | Rubber Black | Sales Revenue | Q1 | 641.0 | 643.0 | -.3 | 2 | | Rubber Black | EBIT | Q1 | 129.0 | 94.0 | 37.2 | | | Rubber Black | Sales Vol YoY % | Q1 | 102.0 | 95.0 | 7.4 | 3 | | Specialist Black | Sales Revenue | Q1 | 210.0 | 211.0 | -.5 | 4 | | Specialist Black | EBIT | Q1 | 25.1 | 21.4 | 17.2 | |

Orion Engineered Carbons USD: 2023 Q4 & FY Results Link...

Orion Engineered Carbons: Q4: Increased demand YoY in speciality and rubber (China). Revenue was flat due to lower pass through of oil prices, partially offset by improved pricing. Gross profit per MT down due to lower cogen pricing (European electricty pricing) and unfavourable product and geographic mix. FY: subdued demand in most markets excepting China. Lower revenue due to oil price pass through and volume, offset my contractual price increases. Gross profit increased due to negotiated contract pricing, offset by lower volumes and cogen revenue. Rubber Segment gross profit per MT increased due to contractual pricing. Speciality Segment gross profit per MT down due to geographic, product mix and cogen. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q4 | 468.2 | 462.1 | 1.3 | | | Carbon Black | adjEBITDA | Q4 | 66.6 | 65.2 | 2.1 | | | Carbon Black | EBITDA | Q4 | 59.4 | 61.8 | -3.9 | | | Carbon Black | EBIT | Q4 | 27.2 | 36.0 | -24.4 | | | Rubber Black | Sales Revenue | Q4 | 319.5 | 315.8 | 1.2 | | | Rubber Black | adjEBITDA | Q4 | 49.2 | 40.3 | 22.1 | | | Rubber Black | Sales Vol MT | Q4 | 171300.0 | 168400.0 | 1.7 | | | Specialist Black | Sales Revenue | Q4 | 148.7 | 146.3 | 1.6 | | | Specialist Black | adjEBITDA | Q4 | 17.4 | 24.9 | -30.1 | | | Specialist Black | Sales Vol MT | Q4 | 54900.0 | 46700.0 | 17.6 | |

RCCL News:

Advanced Tire Chemical Market Demand Analysis - From Rubber Chemical Consultants Ltd Link...

Rubber Chemical Consultants unique proprietary tire chemical market analysis system has been providing clients with in-depth market insights for the past 15 years. If you are interested in finding out more then please contact us.

Contact Us For Further Information »

Nokian Tires: Signs Purchase Agreement for Recovered Carbon Black (rCB) Link...

Nokian Tyres has made a long-term purchase agreement with the tire recycling joint venture (JV), Antin Infrastructure Partners and Scandinavian Enviro Systems. The JV's first plant based in Sweden is expected to be fully operational by 2025 with deliveries to Nokian Tyres beginning in 2026. Nokian Tyres started to use recovered carbon black in a commercial product line in 2022. The long-term purchase agreement with a tire recycling joint venture enables its increased utilization in tires accelerating circularity and sustainability in the tire industry.

Birla Carbon: ISCC Plus Certification for US and Korean Plants Link...

Birla Carbon's plants in Hickok, USA and Yeosu (South Korea) have secured ISCC Plus certification, this follows certification of Birla's Trecate, Italy plant last year. Birla Carbon is actively pursuing ISCC PLUS certification for several other global plants. The certification process for two units in Brazil and three units in India, Spain, Egypt, and Hungary is underway, with the remaining sites slated for completion through the remainder of CY 2024.

Wabtec Rubber Products: Planning to Close Plant in Brenham Link...

Wabtec is planning to close its rubber products plant in Brenham according to a WARN notice filed in January.

Pyrum Innovations ESC GmbH: Construction of New Factory in Perl-Besch Scheduled for 2H 2024 Link...

The Perl-Besch municipal councel has approved the site development plan for Pyrum's new plant. This allows the start of detailed planning and the orderling of plant components with long lead times. The plant in Perl-Besch (Saarland) is expected to be completed by the end of 2025 with a capacity of 20k MT ELT pa.

Pyrum Innovations ESC GmbH: Commissioning New Reactor at Dillingen Site Link...

Pyrum Innovations AG has reported initial successes during commissioning of the new reactor 2 (TAD 2) at their main plant in Dillingen/Saar. Since the start of the second test drive on 30th Jan 2024, the throughput of the new reactor has been gradually increased to 75% of the output expected for future series production within a week. This means that industrial quantities of ELTs can already be processed in TAD 2 proving Pyrum's technology for large-scale rollout. More than 30k liters of oil have already been produced and are now being sampled in the laboratory before being delivered to BASF. The plan is now to keep the throughput in TAD 2 at 75% to 80% over the next few weeks and to optimize the processes between the individual parts of the system. In the further course, TAD 3 is also scheduled to be ramped up to 80% by the end of March 2024, which means a tripling of current production capacities.

Trelleborg A.B.: Acquiring Baron Group A Global Leader in Liquid Silicone Rubber Link...

Trelleborg Group, through its business area, Trelleborg Sealing Solutions signed an agreement to acquire Baron Group, a prominent Australian-Chinese company in the manufacturing of advanced precision silicone components for healthcare and medical applications. The privately held company has its head office and two manufacturing facilities in Australia, as well as two additional facilities in China. The Australian manufacturing facilities are also active in several attractive industrial segments in addition to medical technology.

Trelleborg A.B.: Investing in New Healthcare & Medical Facility in Costa Rica Link...

Trelleborg is investing in a new production facility in Costa Rica for medical technology solutions. The new facility will be established close to a number of international customers with operations in the region. On completion, the facility will offer a full product suite of engineered polymer solutions within healthcare & medical. The state-of-the-art facility is being built in the city of Grecia, close to the port and an international airport, and a half-hour drive from the main cities in western Costa Rica. It will feature cleanroom production and be designed to meet stringent industry-specific standards for medical device manufacturing, as well as ensuring efficient and sustainable production processes. Sustainability will permeate the building, which will be Leadership in Energy & Environmental Design (LEED) certified.

Zeon Corporation: Obtains ISCC Plus Certification for Four Plants in Japan Link...

Zeon Corporation has acquired ISCC PLUS certification for BR, HNBR, IR, NBR, E-SBR and S-SBR at four of its domestic production bases (Takaoka, Kawasaki, Tokuyama and Mizushima plants) with plans to extend the certificaiton to other products in the future.

Evonik Industries: Expanding Precipitated Silica Production at its Charleston, US Plant Link...

Evonik is investing in a new precipitated silica production line at its Charleston, US plant to satisfy high demand, particularly in the tire industry. The group is investing a mid-double-digit million Euro amount. The construction of the new production line is scheduled to begin in mid-2024. Operations will start in early 2026. With the new line in Charleston, the company will increase its production capacity for precipitated silica at the site by 50 percent.

Gabriel-Chemie Group: Expanding Capacity in Hungary Link...

Gabriel-Chemie has announced the commencement of a substantial expansion project at its Nyíregyháza, Hungary production facility. This includes warehousing, office space and additional production lines (unspecified). The project is expected to be complete by end of 2024.

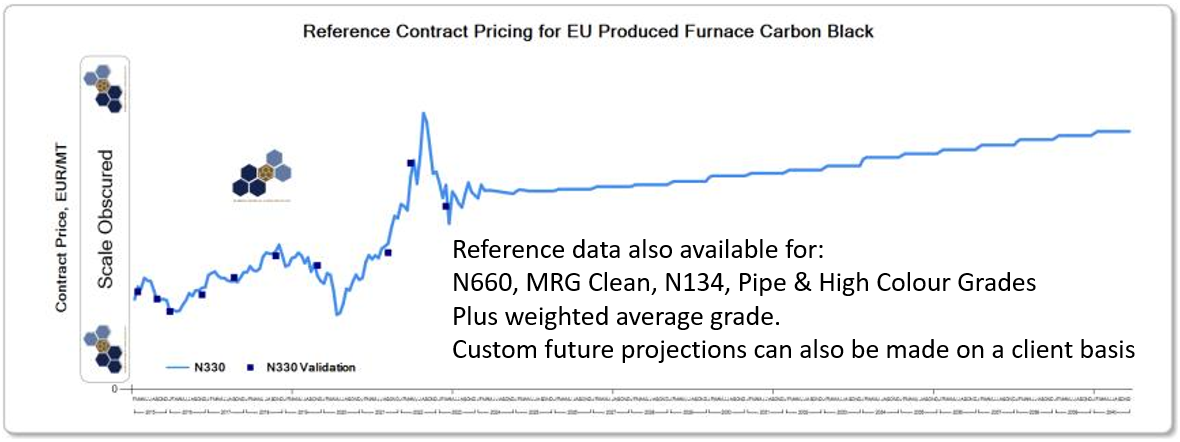

RCCL Analysis: Reference Pricing for EU Produced Furnace Carbon Black January 2024 Link...

Rubber Chemical Consultants Ltd (RCCL) has been analysing the furnace carbon black market since 2009. During this time a detailed contract market pricing model has been developed based

on knowledge of production process economics, raw material input and changing market dynamics. This has allowed RCCL to track historic and current pricing for a range of furnace carbon black products.

Future pricing is predicted based on the average of the last 3 months variable costs incorporating annual increments and projected increases in the fixed cost, SGA and shipping components. This system has

proven particularly useful for future pricing where clients have provided their own confidential variable cost assumptions (treated in strictest confidence by RCCL).

Model predictions have been verified by independent confidential pricing sources.

About Rubber Chemical Consultants Ltd

Rubber Chemical Consultants has been providing client specific analysis since 2009. We specialise in carbon black and its markets as well as rubber chemicals and the Tire and MRG markets.

Please Contact Us For Further Information »

Henniges Automotive Inc: Closing Burlington, Ontario Plant Link...

Henniges Automotive Holdings Inc. is closing its automotive sealings plant in Burlington, Ont., by the end of the year. Henniges Automotive says it will consolidate its operations to existing facilities and expects no disruption in supplying existing or future programs.

Arkema: Increased Capacity of Pebax® Elastomers at its Sequigny, France Plant Link...

Arkema has started its new Pebax® elastomer unit at the Serquigny plant in France. Designed with the latest advancements in industrial processes, the unit can produce both the bio-circular Pebax® Rnew® and classical Pebax® elastomer ranges. The materials are used extensively in sports equipment such as running shoes, soccer shoes and ski boots, but also in electronic devices, and other specialty markets such as antistatic additives and medical devices.

Continental Rubber Group: Enhancing Speciality Tire Production in Sri Lanka Link...

Continental is enhancing local pre-production capacities at its Kalatura, Sri Lanka plant enabling it to produce material handling tires self-sufficiently, thereby reducing cross-country supply chain dependencies. The investment of 13 million Euro will enable further growth for the material handing business.

January (2024)

Orion Engineered Carbons: Completes EPA-Mandated Air Emissions Control Upgrades Link...

Orion has completed upgrading its air emissions control technology at all four of its U.S. carbon black plants – the biggest sustainability-related initiative in the company’s history. The company recently finished its final air emissions project at its plant in Belpre, Ohio. Previously, the company upgraded its Borger, Texas; Ivanhoe, Louisiana; and Orange, Texas, facilities.

Yokohama Rubber: Expanding Production Capacity at its Philippines Plant Link...

The Yokohama Rubber Co., Ltd., is expanding the production capacity of Yokohama Tire Philippines, Inc. boosting the production of PC tires by 1800 tires/day .In addition to expanding capacity of tire sizes currently being produced, the planned expansion will include a new line that will expand YTPI’s size lineup to 21- and 22-inch tires. Expansion work is set to commence in the second quarter of 2024, and the new lines are expected to be fully operational from the second quarter of 2026 when YTPI marks its 30th founding anniversary. Yokohama Rubber’s consumer tire business is endeavoring to increase sales of high-value-added YOKOHAMA tires, including the global flagship ADVAN brand, the GEOLANDAR brand of tires for SUVs and pickup trucks, winter tires, and 18-inch and larger tires. Toward that end, Yokohama Rubber is strengthening its tire development, production, supply, and sales operations in each region to support its effort to expand sales of tires tailored to meet the specific needs of each market.

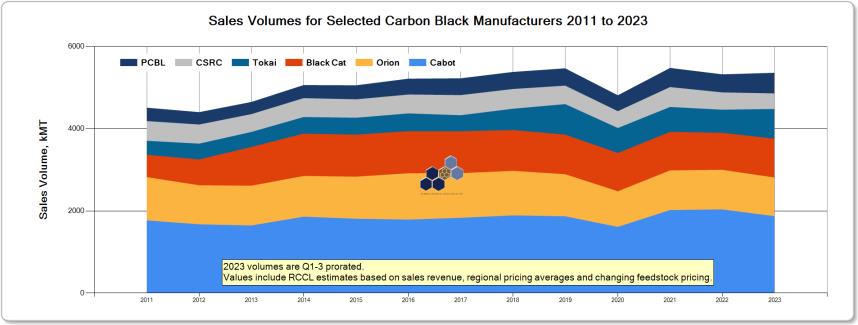

RCCL Analysis: Carbon Black Manufacturers Performance Update January 2024 Link...

Rubber Chemical Consultants Ltd (RCCL) tracks financial data for the main publically listed carbon black manufacturers. This information is used to crosscheck market demand data generated from our Global Tire & Rubber Chemicals Database (GTRCD©) which uses independent market demand drivers for the main market sectors (Tire, MRG, Plastics and Others).

Manufacturer’s financial data, combined with knowledge of each manufacturer’s operations and products also allows for additional analysis and understanding of manufacturing and market trends. Examples of this include product differentiation and evolving trends in volumes and pricing.

The high level data presented in this article allows for general trend analysis.

Sales Volumes

Figure 1 presents annual sales volumes for selected carbon black manufacturers representing approximately 40% of the global carbon black market. These manufacturers cover all the major global regions thereby providing a reasonable approximation for global demand. The data indicates that 2021 volumes returned to levels similar to 2019, however, there has been a downturn in 2022 and a flattening of volumes in 2023. There is significantly more complexity to the underlying regional and country based data which can be discussed on a client basis.

Figure 1 – Annual Sales Volume for Selected Carbon Black Manufacturers 2011 to 2023

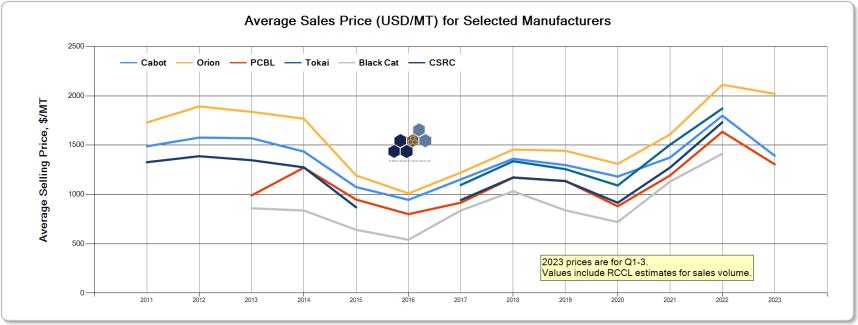

Average Selling Prices

Figure 2 presents the average selling price in USD/MT for same selected carbon black manufacturers. This information shows some important differences between manufacturer’s capabilities and modes of operation as well as general market trends. Orion Engineered Carbons is seen to have the highest average selling price, which is not surprising given Orion’s business focus on differentiated products and its extensive carbon black portfolio (furnace, thermal, gas, lamp and acetylene blacks). Jiangxi Black Cat Carbon Black represents the other end of the market with a focus on high volume, primarily rubber grade carbon blacks. The significant impact of feedstock pricing is seen in 2022 leading to significant price increases for all manufacturers.

Figure 2 – Average Selling Prices for Selected Carbon Black Manufacturers 2011 to 2023

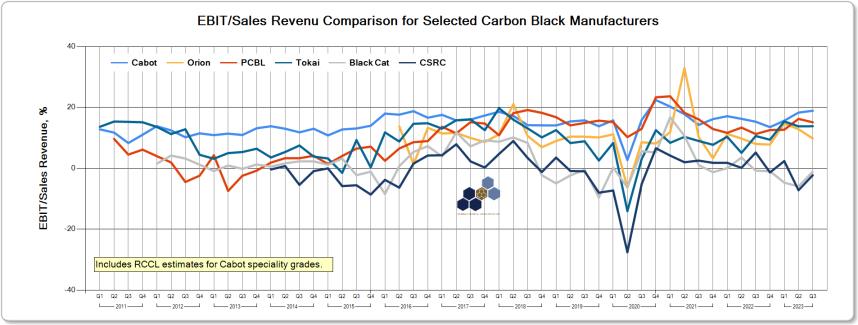

Margin Generation

Figure 3 presents EBIT divided by sales revenue for the same selected carbon black manufacturers. This data indicates that Cabot maintains the most consistent performance for operating margin as a percentage of sales. PCBL is seen to have made significant improvement in margin development which is a result of increasing its market share of specialist grades. Orion Engineered Carbons has been more significantly impacted by energy and feedstock prices with a large proportion of its specialist production based in Europe, this is combined by reduced demand for specialist products from end of 2021 through to 2023. Jiangxi Black Cat Carbon Black and China Synthetic Rubber Corporation (CSRC) are seen to have the lowest margin development, this is a result of volatile feedstock pricing and reduced demand.

Figure 3 – EBIT/SR for Selected Carbon Black Manufacturers 2011 to 2023

More Detailed Analysis

Significantly more insight can be provided on a client basis covering regional (country) market demand, pricing and industry developments. Please contact us for more details.

About Rubber Chemical Consultants Ltd

Rubber Chemical Consultants has been providing client specific analysis since 2009. We specialise in carbon black and its markets as well as rubber chemicals and the Tire and MRG markets.

Please Contact Us For Further Information »

Birla Carbon: Announces New Greenfield Expansions in India and Thailand Link...

Birla Carbon has announced that it will build two new manufacturing plants to support the fast growing markets of India and Southeast Asia. The plants will be built in Niadupet, Andhra Pradesh, India and Rayong, Thailand and will both have an intitial capacity of 120 kMT to be operational in 2025 with potential future expansions to 240 kMT. Previously announced brownfield expansion plans in Hungary, as well as, the post treatment facility expanding Specialty capacity at Patalganga, India, are progressing on plan.

Epsilon Carbon: Planning Integrated Carbon Complex in Odisha Link...

Epsilon Carbon has signed a MoU with the Government of Odisha committing an investment of Rs 10k crores over 10 years to establish an integrated carbon complex in Jharsuguda, Odisha. The ICC project includes carbon black capacity of 300 kMTpa as well as 500 kMT of speciality carbon and 75 kMT of advanced materials.

Wacker Chemie AG: Planning New Production Site for Silicone Specialities in Czech Republic Link...

Wacker Chemie AG is planning to expand its silicone specialities busines and operations in Europe. A new production silte for customised silicone compounds is to be built in Karlovy Vary in the Czech Republic. The expansion is required to support megatrends such as electromobility and renewable energies. The initial production of 20 kMTpa will focus on room-temperature curing speciality silicones with production scheduled for the end of 2025. The raw materials required for production at Karlovy Vary - polymers, fillers and additives - are to be delivered from Wacker's Burghausen site. This initiative enables better usilisation of Wacker's plants with acceleration of process automation.

Metso: Discontinuing Rubber and Poly-Met Wear Parts Manufacturing in Trelleborg, Sweden Link...

Metso has decided to discontinue the factory operations at it Trelleborg plant in Sweden. The factory operations in Trelleborg will be ramped down in stages from the beginning of the second quarter of 2024, with full closure expected in the third quarter. European rubber and Poly-Met customers will be mainly served by Metso’s factory in Lithuania, where production capabilities will be further strengthened. After the closing of the factory in Trelleborg, Metso will have rubber and Poly-Met factories in Mexico, Chile, Brazil, Peru, India, Lithuania, and Australia.

Goodyear: Introduces Electricdrive™ 2 PC Tire with > 50% Sustainable Materials Link...

Goodyear has unveiled the latest tire in its ElectricDrive™ family: The Goodyear® ElectricDrive™ 2, an all-season electric vehicle tire enhanced with sustainable materials, improved rolling resistance and long-lasting tread life to maximize drivers’ EV performance. The new ElectricDrive™ 2 is the latest step in Goodyear’s sustainability initiative and contains at least 50% sustainable materials per tire by weight.

PPG Industries: Reviewing Strategic Alternatives for Silica Products Business Link...

PPG has engaged Morgan Stanley & Co. LLC as financial advisor to assist in a review of strategic alternatives for its silica products business. The business operates within the company’s specialty coatings and materials strategic business unit, and manufactures and supplies precipitated silica products to major manufacturers around the world as performance-enhancing additives. In 2023, the silica products business represented between 1-2% of PPG’s total net sales. PPG expects to complete the review of strategic alternatives by mid-2024. The silica products business is led by about 350 employees and manufactures products through dedicated facilities in Lake Charles, Louisiana and Delfzijl, The Netherlands. In addition, there is small batch processing at a portion of a PPG facility in Barberton, Ohio and part of a PPG facility in Monroeville, Pennsylvania that includes a laboratory, pilot plant, and the leadership and administrative team offices for the business. Key end-uses include tire, industrial and silicone rubber applications; microporous fillers for battery separators; free-flow and carrier agents for food, animal feed, and agricultural and industrial chemicals; and flatting, thickening and anti-corrosion additives for paints and coatings.

December (2023)

China Synthetic Rubber Corporation: 2023 Q3 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q3 | 4509.8 | 6110.9 | -26.2 | | | Carbon Black | EBIT | Q3 | -102.6 | 315.5 | -132.5 | |

Bridgestone: Completes Sale of Russian Assets to S8 Capital Link...

Bridgestone has completed the sale of its tire manufacturing plant in Ulyanovks, together with its sales and marketing office in Moscow, to S8 Capital, a Russian diversified holding company. The sale follows suspension of all manufacturing activities in March 2022.

Sailun Co: Joint Venture Tire Plant for León, Mexico Link...