|

November (2023)

Longxing Chemical Stock: 2023 Q3 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q3 | 1041.5 | 1198.5 | -13.1 | | | All Segments | Gross Margin | Q3 | 121.1 | 92.7 | 30.7 | | | All Segments | EBIT | Q3 | 49.5 | 44.0 | 12.5 | |

August (2023)

Longxing Chemical Stock: 2023 Q2 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q2 | 1036.7 | 1196.9 | -13.4 | | | All Segments | Net Margin | Q2 | 43.9 | 47.7 | -7.8 | | | All Segments | EBIT | Q2 | 41.2 | 58.1 | -29.1 | |

April (2023)

Longxing Chemical Stock: 2023 Q1 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2023/1 | 1119.5 | 1003.3 | 11.6 | | | All Segments | EBIT | 2023/1 | 17.9 | 14.3 | 25.3 | | | All Segments | Net Margin | 2023/1 | 12.7 | 11.4 | 11.6 | |

November (2022)

Longxing Chemical Stock: 2022 Q3 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/3 | 1198.5 | 809.1 | 48.1 | | | All Segments | EBIT | 2022/3 | 44.0 | 18.0 | 144.2 | | | All Segments | Net Margin | 2022/3 | 34.8 | 19.0 | 82.5 | |

September (2022)

Longxing Chemical Stock: 2022 Q2 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/2 | 1196.9 | 858.0 | 39.5 | | | All Segments | EBIT | 2022/2 | 58.1 | 53.4 | 8.8 | | | All Segments | Net Margin | 2022/2 | 47.7 | 43.2 | 10.3 | |

May (2022)

Longxing Chemical Stock: 2022 Q1 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/1 | 1003.3 | 820.4 | 22.3 | | | All Segments | EBIT | 2022/1 | 14.3 | 94.4 | -84.9 | | | All Segments | Net Margin | 2022/1 | 11.4 | 80.1 | -85.7 | |

November (2021)

Longxing Chemical Stock: 2021 Q3 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2021 | 2020 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2021/3 | 809.1 | 614.2 | 31.7 | | | All Segments | Net Margin | 2021/3 | 19.0 | 18.6 | 2.5 | | | All Segments | EBIT | 2021/3 | 18.0 | 23.4 | -22.9 | |

August (2021)

Longxing Chemical Stock: 2021 Q2 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2021 | 2020 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2021/2 | 858.0 | 497.2 | 72.6 | | | All Segments | EBIT | 2021/2 | 53.4 | 1.2 | 4225.2 | | | All Segments | Net Margin | 2021/2 | 43.2 | 1.4 | 3037.4 | |

May (2021)

Longxing Chemical Stock: 2020 FY Results Link...

Longxing Chemical Stock: Careful management of feedstock supply was implemented in 2H 2020 due to environmental restrictions in Northern China impacting coking and coal tar production. Domestic market conditions improved dramatically in 2H 2020. Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2020 | 2019 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2020 | 2295.7 | 2805.9 | -18.2 | | | All Segments | EBIT | 2020 | 102.7 | 22.7 | 353.3 | | | All Segments | Net Margin | 2020 | 77.5 | 19.2 | 303.0 | | | All Segments | Sales Revenue | 2020/4 | 713.0 | 662.6 | 7.6 | | | All Segments | EBIT | 2020/4 | 74.3 | -10.5 | 806.5 | | | All Segments | Net Margin | 2020/4 | 56.2 | -4.7 | 1288.1 | |

August (2020)

Longxing Chemical Stock: 2020 Q2 Results Link...

Longxing Chemical Stock: Demand and selling price impacted due to COVID-19. First half carbon black sales volume down 14.5% YoY. The company is focusing on R&D investment for new products and process efficiency. Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2020 | 2019 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2020/2 | 497.2 | 720.1 | -30.9 | | | All Segments | Gross Margin | 2020/2 | 66.5 | 89.1 | -25.4 | | | All Segments | EBIT | 2020/2 | 1.2 | 9.6 | -87.2 | |

April (2020)

Longxing Chemical Stock: 2019 Full Year Results Link...

Longxing Chemical Stock: Carbon black demand reduced suppressing prices. Domestic tire production started to decline from March 2019. Increased domestic capacity for carbon black has led to oversupply causing further downward pricing pressure. Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2019 | 2018 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2019 | 2589.2 | 2872.1 | -9.8 | | | Carbon Black | Gross Margin | 2019 | 256.1 | 436.6 | -41.3 | | | Carbon Black | Sales Vol MT | 2019 | 456561.0 | 440237.5 | 3.7 | |

Longxing Chemical Stock: 2020 Q1 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2020 | 2019 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2020/1 | 471.4 | 690.6 | -31.7 | | | All Segments | Gross Margin | 2020/1 | 69.4 | 72.8 | -4.6 | | | All Segments | Net Margin | 2020/1 | 1.3 | 1.6 | -21.0 | |

February (2020)

Longxing Chemical Stock: 2019 Results Preliminary Update Link...

Reporting period was adversely affected by the US-China trade dispute and close to double digit negative growth in domestic automobile production and sales. This was further compounded by additional furnace carbon black capacity growth leading to over supply as well as weakened market demand. Operating income has dropped by 9.1% YoY with an 86.4% drop in operating profit.

January (2020)

Longxing Chemical Stock: Sharp Decline in Performance in 2019 Link...

A combination of weakened market demand and intensified industry competition led to a sharp decline in financial performance for 2019. Pricing levels reduced faster than feedstock pricing impacting gross margin.Market volumes reduced due to the trade war and poor domestic automotive market performance. Competition in the market has intensified with approximately one million tons of additional capacity added in the past two years - overcapaity therefore becomes an issue.

October (2019)

Longxing Chemical Stock: 2019 Q3 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2019 | 2018 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2019/3 | 732.6 | 833.7 | -12.1 | | | All Segments | Direct Total | 2019/3 | 627.1 | 695.8 | -9.9 | | | All Segments | Gross Margin | 2019/3 | 89.1 | 137.6 | -35.3 | | | All Segments | Net Margin | 2019/3 | 15.2 | 34.8 | -56.3 | |

August (2019)

Longxing Chemical Stock: 2019 Q2 Results Link...

Longxing Chemical Stock: Q2 Net profit down 86% YoY mainly due to the impact of lower sales prices due to weakening market conditions. During the period the sales price dropped 10.54% while the manufacturing cost dropped 2.44%. Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2019 | 2018 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2019/2 | 720.1 | 783.8 | -8.1 | | | All Segments | Net Margin | 2019/2 | 7.2 | 31.3 | -77.1 | | | Carbon Black | Sales Revenue | 2019/2 | 1321.1 | 1367.0 | -3.4 | |

May (2019)

Longxing Chemical Stock: 2019 Q1 Results Link...

Longxing Chemical Stock: Downward trend from 2018 Q4 continues into 2019 Q1. Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2019 | 2018 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2019/1 | 690.6 | 680.2 | 1.5 | | | All Segments | Gross Margin | 2019/1 | 72.8 | 131.9 | -44.8 | | | All Segments | Net Margin | 2019/1 | 1.6 | 31.9 | -95.0 | |

February (2019)

Longxing Chemical Stock: 2018 FY and Q4 Results Link...

Longxing Chemical Stock: Longxing's overall net profit has increased from 50 MM RMB in 2017 to 133 MM RMB in 2018. Gross margin as a percentage of sales for the carbon black business droped from 17.2 to 15.2 percent over this period. Contributions to the increased net profit come from reduced sales costs and reduced financial expense plus others. Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2018 | 2017 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2018 | 2872.1 | 2457.2 | 16.9 | | | Carbon Black | Gross Margin | 2018 | 436.6 | 423.6 | 3.1 | | | All Segments | Sales Revenue | 2018/4 | 941.6 | 719.9 | 30.8 | | | All Segments | Net Margin | 2018/4 | 37.6 | -19.7 | 291.0 | |

April (2018)

Longxing Chemical Stock: 2017 Full Year and Q4 Results Link...

Longxing Chemical Stock: Margin gains from improved market conditions as a result of more stringent environmental controls within China. Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2017 | 2016 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2017/4 | 719.9 | 510.1 | 41.1 | | | All Segments | Gross Margin | 2017/4 | 123.1 | 113.5 | 8.5 | | | All Segments | Net Margin | 2017/4 | -19.7 | 16.1 | -222.0 | | | Carbon Black | Sales Revenue | 2017 | 2457.2 | 1622.0 | 51.5 | | | Carbon Black | Gross Margin | 2017 | 423.6 | 307.1 | 37.9 | |

October (2017)

Longxing Chemical Stock: Q3 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments. Longxing Chemical Stock: CNY Millions | Segment | Parameter | Period | 2017 | 2016 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2017/3 | 723.1 | 510.2 | 41.7 | | | All Segments | Direct Total | 2017/3 | 586.9 | 395.0 | 48.6 | | | All Segments | Gross Margin | 2017/3 | 136.2 | 115.2 | 18.3 | | | All Segments | Net Margin | 2017/3 | 29.0 | 24.3 | 19.5 | |

August (2017)

Longxing Chemical Stock: Q2 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments. Longxing Chemical Stock: CNY Millions | Segment | Parameter | Period | 2017 | 2016 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2017/2 | 1134.7 | 727.7 | 55.9 | | | Carbon Black | Direct Total | 2017/2 | 930.0 | 608.3 | 52.9 | | | Carbon Black | Gross Margin | 2017/2 | 204.6 | 119.4 | 71.3 | | | Precipitated Silica | Sales Revenue | 2017/2 | 49.9 | 32.2 | 54.9 | | | Precipitated Silica | Direct Total | 2017/2 | 35.6 | 23.0 | 54.5 | | | Precipitated Silica | Gross Margin | 2017/2 | 14.3 | 9.2 | 55.8 | |

May (2017)

Longxing Chemical Stock: 2017 Q1 Results Link...

Longxing Chemical Stock: CNY Millions | Segment | Parameter | Period | 2017 | 2016 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2017/1 | 542.1 | 366.2 | 48.0 | | | All Segments | Direct Total | 2017/1 | 437.4 | 308.3 | 41.9 | | | All Segments | Gross Margin | 2017/1 | 104.7 | 57.9 | 80.9 | | | All Segments | Net Margin | 2017/1 | 17.4 | -22.8 | 176.1 | |

RCCL Industry Analysis:

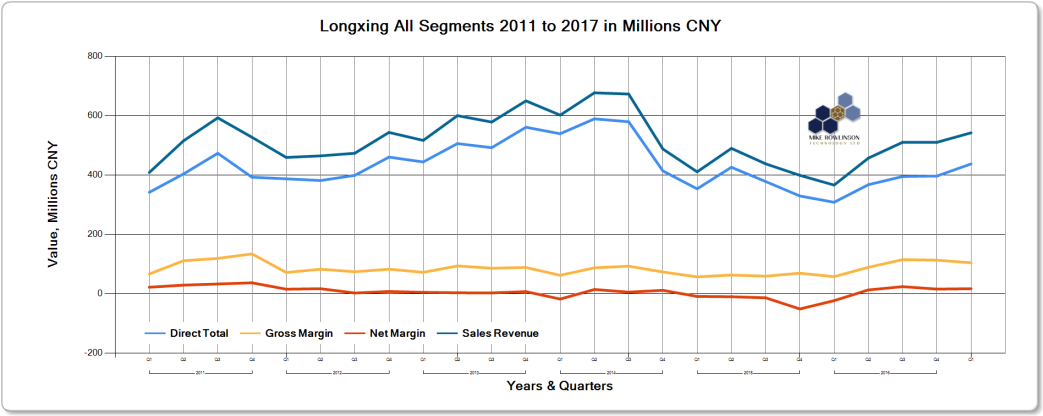

Analysis Snippet: Longxing Chemical Stock Longxing's main segment is carbon black, they also produce precipitated silica (starting production in 2013), polyvinylidene flouride and products from coal tar. The figure below shows quarterly data for sales, direct costs, gross margin and net margin. The recent trend (divergence of sales revenue and direct costs with a resulting improvement in net margin) from the middle of 2016 is in line with other reports (Jiangxi Black Cat) and also Cabot who also report a recovery in the carbon black market, especially in China with strengthening prices and demand. The recovery in China has been partially attributable to efforts to eliminate outdated manufacturing units thereby reducing the huge production surplus in the country, the upturn in the tire market has also had a signficant effect. More detailed insight for furnace carbon black and precipitated silica is availabe upon request from MRT.

April (2017)

Longxing Chemical Stock: 2016 Full Year Results Link...

Longxing Chemical Stock are one of the leading furnace carbon black producers in China. Longxing have also branched out into precipitated silica production and are in the early phases of market development for this product. Longxing Chemical Stock: CNY Millions | Segment | Parameter | Period | 2016 | 2015 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2016 | 1622.0 | 1567.0 | 3.5 | | | Carbon Black | Gross Margin | 2016 | 307.1 | 197.5 | 55.5 | | | Precipitated Silica | Sales Revenue | 2016 | 79.9 | 65.4 | 22.0 | | | Precipitated Silica | Gross Margin | 2016 | 23.4 | 15.4 | 52.3 | |

2016 notes:Longxing report improved domestic furnace carbon black market conditions, especially in the second half of 2016. This has resulted from state driven changes in efficiency and environmental legislation leading to the closure of obsolete production facilities. There has also been an improvement in domestic tire market production.

October (2016)

Longxing Chemical Stock: 2016 Q3 Results Link...

All Segments: YOY income increased 17% with an increase in margin from a loss of -13.3 MM Yuan to +24.3 MM Yuan. QOQ income increased 12% with an 83% improvement in margin.

August (2016)

Longxing Chemical Stock: 2016 Q2 Results Link...

All Segments: YOY 7% reduction in income with marin increase to +13.2 MM Yuan from -9.7 MM Yuan. QOQ 25% increase in income with marking inread to 13.2 MM Yuan from -22.8 MM Yuan.

April (2016)

Longxing Chemical Stock: 2016 Q1 Results Link...

All Segments: YOY income reduced by 11% and net marging reduced from -8.7 to - 22.8 MM Yuan. QOQ income dropped by 8% and margin improved from a loss of - 65 MM to -22.8 MM Yuan.

Longxing Chemical Stock: 2015 FY Results Link...

Carbon Black: Sales revenue dropped by 28.7% and net profit was -8.2 MM RMB which is a decrease of 650% YOY. Market pressures on export business led to a drop in export volumes with higher domestic volume at reduced prices.

|